Product Fair Value Assessments

properties.trackTitle

properties.trackSubtitle

In accordance with FCA PROD Rules 4.2.29 R, we are sharing the following information about our products with our distributors:

- Product target market statements – these provide you with key information about the intended target market of each product. Our Target Market Statements clarify who our products are designed for, who they are not intended to support, and how we expect the product to be distributed to customers; and

- The outcome of fair value assessments - these provide you with the outcome and conclusion of the full fair value assessment that we have completed.

The information displayed on this page is intended for distributors only and must not be provided to the end customer / insured.

Please speak with your underwriting contact directly if you require specific product information to share with customers, such as policy wordings and IPIDs.

Product Information Exchange (PIE) Forms will enable us to collect information to complete the Fair Value Assessments. A link to the PIE form for GrovesJohnWestrup Private Clients can be found here.

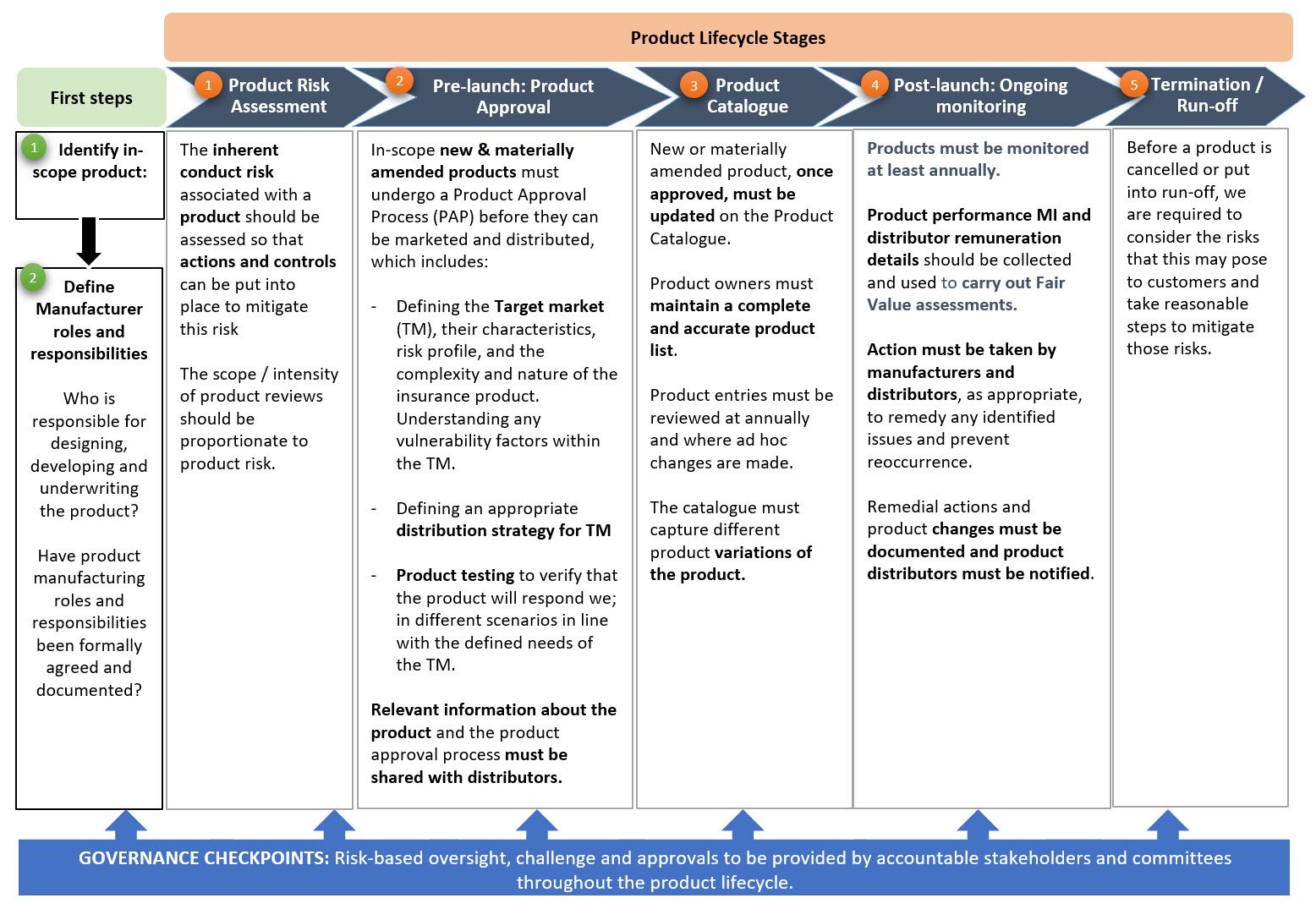

Product Governance Process

Fair Value Assessment Criteria

We assess whether our products and services deliver fair value for money, by considering the relationship between the price paid by our customers and the quality or benefits and services that they receive. The assessment of fair value includes review of the following management information, feedback and insights obtained throughout the product lifecycle:

- Benchmarking against other insurers

- Loss ratios and premium adequacy

- Conduct risk metrics

- Complaints data

- Commission ranges

- Distributor feedback

The following is excluded from the review and as a distributor you must consider:

- Any additional fees that you charge a customer and the effect on the value of the product

- Any ancillary or additional products (including Retail Premium Finance) sold alongside the product which may affect the value of the product or duplicate cover provided by the product

Target Market Statements and Fair Value Assessments

High-Net-Worth Household

Fair Value Assessment

This is a high-net-worth property insurance product providing cover for buildings and/or contents, home emergency, legal expenses, home cyber and legal liability to the public. Where contents cover is selected, the product provides cover for accidents to domestic employees. Contents cover can be extended to provide insurance for valuables, antiques and works of art.

Outcome of Fair Value Assessment

Fair Value

Family Travel

Fair Value Assessment Document

This is an optional additional travel insurance product (sold alongside the high-net-worth property product) providing cover for cancellation, curtailment, repatriation, medical expenses, loss of baggage, and winter sport cover

Outcome of Fair Value Assessment

Fair Value

Distributor responsibilities

Distributors are required to provide manufacturers with information on remuneration and services provided in the chain as set out under the PROD rule 4.2.14P R. In order to provide such information, we have created a Product Information Exchange Questionnaire for distributors to complete.

We expect distributors to disclose the nature and basis of remuneration to the customer and to ensure that remuneration does not conflict with the customers’ best interest rule.